There’s this thing called THE MARKET – and it’s smarter than you. I know you don’t want to hear that.

The MARKET is actually smarter than me too. And you know I don’t want to admit to that.

Many moons ago, I went to University and got a Bachelor of Commerce (in between trips to the pub). While much of what I learned isn’t relevant in my world today, (don’t get me started on debits and credits), I still remember this:

A Market is a place where Buyers and Sellers meet to exchange something

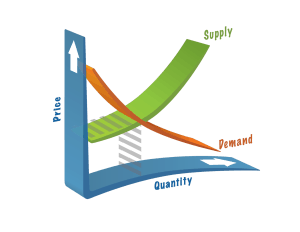

The Law of Supply and Demand is the relationship between supply, demand and price. More specifically:

The Law of Supply and Demand is the relationship between supply, demand and price. More specifically:

- Increased demand results in increased prices;

- Decreased demand results in decreased prices;

- Decreased supply increases prices.

- Increased supply decreases prices;

I regularly come across Buyers and Sellers who think they know it all – and think they can beat the market. Here are 3 important lessons about the real estate market:

Lesson #1 Market Value: The MARKET dictates how much a house is worth. Not just the Seller. Not just the Buyer. And certainly not the real estate agent. The point when a Seller and Buyer agree to exchange a house for a certain amount of money is called market value.

Houses that are overpriced don’t sell. Houses that are underpriced get multiple offers. That’s the market doing its thing.

Scenario #1: Multiple Offers

Here’s a scenario we often see when a house receives multiple offers:

- A house is priced at $599K and the Sellers set an ‘offer date’ in 7 days, in the hopes of getting multiple Buyers to make offers at the same time.

- The Seller receives 8 offers.

- One or two of those offers is usually below or at the asking price.

- One or two of the Buyers REALLY want the house and have offered a ton of money – let’s say, around $700K.

- Everybody else usually ends up congregating around one or two numbers (usually the number that’s supported by the recent sales in the neighbourhood). For the sake of my example, let’s say 2 offers are at or around $650K and 2 offers are around $660K.

- The house sells for $710K.

Here’s what the market did: there was low supply and high demand. While most Buyers in this example felt the house was worth around $650K, the laws of the market drove that price higher and the Seller was lucky to find a Buyer who was willing to pay more. Good for the Seller, bad for the Buyers whose offers didn’t get accepted.

Scenario #2: The Overpriced Home

Here’s another common scenario:

- A house is listed for $769K

- A few days later, the Seller receives an offer for $730K and turns it down.

- Two weeks later they receive another offer – this time at $725K.

- A month later another offer is received at $735K.

If 3 Buyers are making offers around the same number, like it or not, that’s likely how much that house is worth. Sellers who are motivated to sell will listen to what the Buyers are saying and eventually accept a lower price, while some Sellers will decide to take their house off the market and wait for prices to increase.

Here’s what the market did: there was low demand for the house at $769K so Buyers refused to meet the Seller at their asking price. Only when the price is lowered to what the Buyers are prepared to pay, will this house sell.

Scenario #3: Cherry-Picking Buyers and Sellers

Scenario #3: Cherry-Picking Buyers and Sellers

We often see Sellers justify overpricing their condo or house by cherry-picking the comparable sales that support a high price and ignoring the comparable sales that point to a lower price. Without a doubt, we see Buyers doing just the opposite too – only considering the lower comparable sales and making low-ball offers.

The truth: neither the Buyer or the Seller is right. The most recent and most similar sales matter the most. And in a condo, similar (if not exact) sales are easy to identify.

So how does the market deal with cherry-picking Sellers and Buyers? The property for sale stays on the market and almost inevitably sells for lower than what it was worth when it first went on the market. And the cherry-picking Buyer? He makes offer after offer, losing out on good properties, while continuing to pay rent and watching prices increase.

Lesson #2 Timing the Real Estate Market: Nobody has a crystal ball – and it’s almost impossible to ‘time the market’. Here are two scenarios we repeatedly see:

Scenario #1 Waiting to Buy Until the Crash

Scenario #1 Waiting to Buy Until the Crash

Every year I run into Buyers who’ve decided to postpone their search ‘until the real estate crash’ so they’ll be able to buy a house “for cheap”. There are 3 problems with this thinking:

- Problem #1…How will you know when ‘the bottom’ is reached? The thing about ‘the bottom’ is that we only know it was the bottom once things have improved and we aren’t at the bottom anymore.

- Problem #2...If it was really that easy to time the market, wouldn’t everyone be millionaires? Wouldn’t we all have bought Google stock when they first went public and sold our oil stocks last year?

- Problem #3...While you’ve been waiting for the market to crash, house prices in Toronto have continued to increase. For example: if you’ve been sitting by the sidelines waiting for the last 5 years, you haven’t been able to benefit from the 47% increase in prices across the GTA. While you’ve been waiting, you’ve been paying someone else’s mortgage (your landlord) and you haven’t been building any equity. If prices decrease by 47%, you’ll be paying the same as you would have 5 years ago – so I wouldn’t exactly call that buying on the cheap. And what are the chances the market decreases by more than 50%?

Scenario #2: Selling and Renting Until the Market Crashes and Re-buying When it Recovers

We often come across Sellers who want to sell while the market is high and lock in their returns. The plan is usually to rent in the meantime, wait for the crash, and get back into the property market when things recover.

The problem? Most of the Sellers who used this strategy in the last 5 are now priced out of the market. The $508,000 they sold their detached house for in 2010 now only buys them a 2 bedroom condo – and to re-buy their same house, it would cost them $792,000 – 56% MORE. Ouch.

Timing the market is a dangerous game to play with your primary residence. And your retirement money.

Lesson #3: The “Below-Market” House: There’s no such thing as buying “below market value” in a hot market like Toronto’s…even if you really really really want to buy a below-market house.

Problem #1….If a house is under priced, the market will drive the price higher in a bidding war. Active Buyers and their agents jump on houses that have been underpriced and that house almost inevitably ends up selling at a higher price – we call that the market value.

Problem #2…What a house sells at IS the market value. If nobody wants to pay $800,000 for a house listed at $800,000, than that’s not market value. If the only offer the Sellers get is for $750,000 and they decide to accept that offer, than that’s market value. Just because it didn’t meet the Sellers’ expectations doesn’t mean it was a bargain or a deal or below market value- it’s just the value that the market was prepared to pay for it.

The real estate market is a funny thing – we don’t control it as Buyers, as Sellers or as real estate agents. But we can learn from it.

http://www.getwhatyouwant.ca/the-market-is-smarter-than-you