Posted on

October 29, 2015

by

Emma Van de Wetering

CTVNews.ca Staff

Published Thursday, October 29, 2015 12:37PM EDT

Last Updated Thursday, October 29, 2015 4:07PM EDT

A new report from the Canada Mortgage and Housing Corporation has found overvaluation in 11 housing markets across the country, as well as other “problematic conditions” in cities like Toronto, Winnipeg and Saskatoon.

The housing market assessment report, released Thursday, says that overvaluation and price acceleration are the main issues in Toronto, while such cities as Winnipeg, Saskatoon and Regina are seeing overbuilding and overvaluation.

The CMHC analyzed housing markets in 15 census metropolitan areas and found “weak evidence” of problematic conditions at the national level. However, overvaluation and overbuilding have been noted in several regions across the country.

He said that housing price levels in Toronto, Vancouver, Montreal, Edmonton and Saskatoon are “not fully supported by economic and demographic factors.”

CMHC says it’s monitoring for “the potential emergence of overbuilding” in Toronto, Montreal and Ottawa, especially when it comes to condos.

While some overvaluation was detected in Vancouver, “overheating, acceleration in house prices and overbuilding are not a concern in this market,” the CMHC says.

During a teleconference call with reporters on Thursday, Dugan said the CMHC’s latest quarterly assessment is meant to be “an early warning indicator” for housing markets, well before they are “so far down the road that a crash is inevitable.”

The CMHC says it’s trying to get the message out to home builders and other players so that adjustments can be made.

Dugan said overvaluation is driven by varying factors, depending on the metropolitan area.

In Vancouver and Toronto, for example, there’s strong price growth and market pressure due to increased sales of single homes valued at $1 million and higher.

In cities such as Regina, Saskatoon and Winnipeg, overvaluation is linked to “weakened fundamentals,” including disposable income, mortgage rates and population growth, Dugan said.

The loss of jobs and revenue from the oil and gas sector in Western Canada has also been linked to softening real estate prices in cities including Calgary and Regina.

Posted on

October 11, 2015

by

Emma Van de Wetering

There’s this thing called THE MARKET – and it’s smarter than you. I know you don’t want to hear that.

The MARKET is actually smarter than me too. And you know I don’t want to admit to that.

Many moons ago, I went to University and got a Bachelor of Commerce (in between trips to the pub). While much of what I learned isn’t relevant in my world today, (don’t get me started on debits and credits), I still remember this:

A Market is a place where Buyers and Sellers meet to exchange something

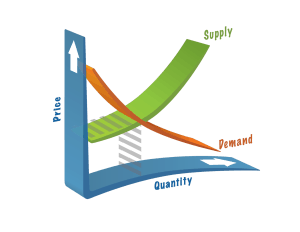

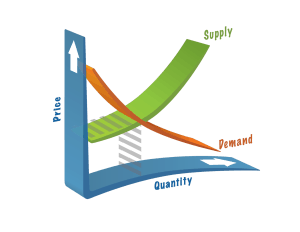

The Law of Supply and Demand is the relationship between supply, demand and price. More specifically: The Law of Supply and Demand is the relationship between supply, demand and price. More specifically:

- Increased demand results in increased prices;

- Decreased demand results in decreased prices;

- Decreased supply increases prices.

- Increased supply decreases prices;

I regularly come across Buyers and Sellers who think they know it all – and think they can beat the market. Here are 3 important lessons about the real estate market:

Lesson #1 Market Value: The MARKET dictates how much a house is worth. Not just the Seller. Not just the Buyer. And certainly not the real estate agent. The point when a Seller and Buyer agree to exchange a house for a certain amount of money is called market value.

Houses that are overpriced don’t sell. Houses that are underpriced get multiple offers. That’s the market doing its thing.

Scenario #1: Multiple Offers

Here’s a scenario we often see when a house receives multiple offers:

- A house is priced at $599K and the Sellers set an ‘offer date’ in 7 days, in the hopes of getting multiple Buyers to make offers at the same time.

- The Seller receives 8 offers.

- One or two of those offers is usually below or at the asking price.

- One or two of the Buyers REALLY want the house and have offered a ton of money – let’s say, around $700K.

- Everybody else usually ends up congregating around one or two numbers (usually the number that’s supported by the recent sales in the neighbourhood). For the sake of my example, let’s say 2 offers are at or around $650K and 2 offers are around $660K.

- The house sells for $710K.

Here’s what the market did: there was low supply and high demand. While most Buyers in this example felt the house was worth around $650K, the laws of the market drove that price higher and the Seller was lucky to find a Buyer who was willing to pay more. Good for the Seller, bad for the Buyers whose offers didn’t get accepted.

Scenario #2: The Overpriced Home

Here’s another common scenario:

- A house is listed for $769K

- A few days later, the Seller receives an offer for $730K and turns it down.

- Two weeks later they receive another offer – this time at $725K.

- A month later another offer is received at $735K.

If 3 Buyers are making offers around the same number, like it or not, that’s likely how much that house is worth. Sellers who are motivated to sell will listen to what the Buyers are saying and eventually accept a lower price, while some Sellers will decide to take their house off the market and wait for prices to increase.

Here’s what the market did: there was low demand for the house at $769K so Buyers refused to meet the Seller at their asking price. Only when the price is lowered to what the Buyers are prepared to pay, will this house sell.

Scenario #3: Cherry-Picking Buyers and Sellers Scenario #3: Cherry-Picking Buyers and Sellers

We often see Sellers justify overpricing their condo or house by cherry-picking the comparable sales that support a high price and ignoring the comparable sales that point to a lower price. Without a doubt, we see Buyers doing just the opposite too – only considering the lower comparable sales and making low-ball offers.

The truth: neither the Buyer or the Seller is right. The most recent and most similar sales matter the most. And in a condo, similar (if not exact) sales are easy to identify.

So how does the market deal with cherry-picking Sellers and Buyers? The property for sale stays on the market and almost inevitably sells for lower than what it was worth when it first went on the market. And the cherry-picking Buyer? He makes offer after offer, losing out on good properties, while continuing to pay rent and watching prices increase.

Lesson #2 Timing the Real Estate Market: Nobody has a crystal ball – and it’s almost impossible to ‘time the market’. Here are two scenarios we repeatedly see:

Scenario #1 Waiting to Buy Until the Crash Scenario #1 Waiting to Buy Until the Crash

Every year I run into Buyers who’ve decided to postpone their search ‘until the real estate crash’ so they’ll be able to buy a house “for cheap”. There are 3 problems with this thinking:

- Problem #1…How will you know when ‘the bottom’ is reached? The thing about ‘the bottom’ is that we only know it was the bottom once things have improved and we aren’t at the bottom anymore.

- Problem #2...If it was really that easy to time the market, wouldn’t everyone be millionaires? Wouldn’t we all have bought Google stock when they first went public and sold our oil stocks last year?

- Problem #3...While you’ve been waiting for the market to crash, house prices in Toronto have continued to increase. For example: if you’ve been sitting by the sidelines waiting for the last 5 years, you haven’t been able to benefit from the 47% increase in prices across the GTA. While you’ve been waiting, you’ve been paying someone else’s mortgage (your landlord) and you haven’t been building any equity. If prices decrease by 47%, you’ll be paying the same as you would have 5 years ago – so I wouldn’t exactly call that buying on the cheap. And what are the chances the market decreases by more than 50%?

Scenario #2: Selling and Renting Until the Market Crashes and Re-buying When it Recovers

We often come across Sellers who want to sell while the market is high and lock in their returns. The plan is usually to rent in the meantime, wait for the crash, and get back into the property market when things recover.

The problem? Most of the Sellers who used this strategy in the last 5 are now priced out of the market. The $508,000 they sold their detached house for in 2010 now only buys them a 2 bedroom condo – and to re-buy their same house, it would cost them $792,000 – 56% MORE. Ouch.

Timing the market is a dangerous game to play with your primary residence. And your retirement money.

Lesson #3: The “Below-Market” House: There’s no such thing as buying “below market value” in a hot market like Toronto’s…even if you really really really want to buy a below-market house.

Problem #1….If a house is under priced, the market will drive the price higher in a bidding war. Active Buyers and their agents jump on houses that have been underpriced and that house almost inevitably ends up selling at a higher price – we call that the market value.

Problem #2…What a house sells at IS the market value. If nobody wants to pay $800,000 for a house listed at $800,000, than that’s not market value. If the only offer the Sellers get is for $750,000 and they decide to accept that offer, than that’s market value. Just because it didn’t meet the Sellers’ expectations doesn’t mean it was a bargain or a deal or below market value- it’s just the value that the market was prepared to pay for it.

The real estate market is a funny thing – we don’t control it as Buyers, as Sellers or as real estate agents. But we can learn from it.

http://www.getwhatyouwant.ca/the-market-is-smarter-than-you

Posted on

September 15, 2015

by

Emma Van de Wetering

The average price of a Canadian home sold in August hit $433,367, an increase of 8.7 per cent in the past year, according to the Canadian Real Estate Association said Tuesday.

CREA said that beyond prices, more homes were sold during the month, too. Sales rose by four per cent compared to August last year.

August is typically a busy month for home sales. The number last month marked the third-highest sales figure on record, after 2005 and 2007.

As the realtor group has reiterated, Toronto and Vancouver continue to skew the national average higher.

"Prices continue to rise in Ontario and British Columbia, where listings are either in short supply or heading in that direction," says Gregory Klump, CREA's chief economist.

Stripping out those cities, the average Canadian home was worth $338,755 in August, with the year-over-year gain reduced to 4.2 per cent.

Across the country, the sales-to-listings ratio was at 56.7 per cent.

CREA says a reading between 40 and 60 suggests a market that is "balanced," with a number higher than that range suggesting a seller's market, and one below suggesting the buyers have the advantage.

Posted on

August 13, 2015

by

Emma Van de Wetering

A Port Coquitlam family hopes Tri-City residents will take a moment to enjoy a cool ice cream treat this Thursday, Aug. 13, and help support the BC Children's Hospital.

Thursday is Miracle Treat Day when proceeds from Blizzards sold at participating Dairy Queens will support critical research, education and life-saving equipment for the hospital that helps so many sick children, including Clara Howorth, who was five when she was diagnosed with leukemia.

Today, after more than two years of treatment, Clara's cancer is now in remission and the Grade 4 Blakeburn elementary student is winning prizes for her dancing.

Her mom, Andrea, says the family is extremely grateful for the care and support Clara received at BC Children's and hopes Tri-City residents will join them in a Blizzard treat so other families will get similar treatment.

In all, about 840 youngsters are in active treatment for cancer at BC Children's Hospital each year.

"What a great excuse for an ice cream," Howorth said, who said her daughter has bounced back and is an active, happy, healthy young girl.

"We credit children's hospital for saving Clara's life," Howarth noted.

She said other children in the Tri-City area have been stricken with cancer recently and all are getting treatment at BC Children's Hospital so visiting Dairy Queen Thursday will, in a way, help them, too.

"We're really trying to spread the word and support these charities," Howarth added.

BC Children’s Hospital is the province’s only full-service acute-care hospital and serves close to one million children living in B.C. and the Yukon. All children who are seriously ill or injured are referred to Children’s Hospital and are either treated at the hospital facility in Vancouver or, with consultation from Children’s specialists, in their home community. Last year, more than 84,000 children were treated at Children’s Hospital. Funds raised by BC Children’s Hospital Foundation are used to support BC Children’s Hospital, its research institute and Sunny Hill Health Centre for Children.

This year marks the 13th annual Miracle Treat Day; Dairy Queen has been involved with Children’s Miracle Network since 1984 raising more than $100 million nationwide.

© Copyright 2015 Tri-City News - See more at: http://www.tricitynews.com/community/ice-cream-and-miracles-in-port-coquitlam-1.2027019#sthash.S5hIQTjx.szAZ99Gi.dpuf

Posted on

August 5, 2015

by

Emma Van de Wetering

Summer heat doesn’t slow home buyer activity

Metro Vancouver home sales were more than a third above the 10-year average in July, while the number of homes listed for sale continues to trend below recent years.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Metro Vancouver* reached 3,978 on the Multiple Listing Service® (MLS®) in July 2015. This represents a 30 per cent increase compared to the 3,061 sales recorded in July 2014, and a decrease of 9.1 per cent compared to the 4,375 sales in June 2015.

Last month’s sales were 33.5 per cent above the 10-year sales average for the month.

“Today’s activity continues to benefit sellers as home buyers compete for the homes available for sale,” Darcy McLeod, REBGV president said.

New listings for detached, attached and apartment properties in Metro Vancouver totalled 5,112 in July. This represents a 3.8 per cent increase compared to the 4,925 new listings reported in July 2014.

The total number of properties currently listed for sale on the region’s MLS® is 11,505, a 26.3 per cent decline compared to July 2014 and a 5.5 per cent decline compared to June 2015.

"Much of today’s activity can be traced to strong consumer confidence, low interest rates, and a reduced supply of homes for sale.” McLeod said. “We have about 5,000 to 6,000 fewer homes for sale today than we've seen at this time of year over the last five to six years,"

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $700,500. This represents an 11.2 per cent increase compared to July 2014.

With the sales-to-active-listings ratio at 34.6 per cent, the region remains in seller's market territory.

“Although there aren’t as many homes for sale today compared to recent years, home buyers continue to have a range of housing options, at different price points, to choose from across Metro Vancouver,” McLeod said. “The diversity of housing options is part of what’s driving today’s demand.”

Sales of detached properties in July 2015 reached 1,559, an increase of 17.9 per cent from the 1,322 detached sales recorded in July 2014, and a 24.8 per cent increase from the 1,249 units sold in July 2013. The benchmark price for a detached property in Metro Vancouver increased 16.2 per cent from July 2014 to $1,141,800.

Sales of apartment properties reached 1,729 in July 2015, an increase of 42.7 per cent compared to the 1,212 sales in July 2014, and an increase of 42.9 per cent compared to the 1,210 sales in July 2013. The benchmark price of an apartment property increased 5.9 per cent from July 2014 to $400,900.

Attached property sales in July 2015 totalled 690, an increase of 30.9 per cent compared to the 527 sales in July 2014, and a 41.7 per cent increase from the 487 attached properties sold in July 2013. The benchmark price of an attached unit increased 7.8 per cent between July 2014 and 2015 to $511,500.

Posted on

July 30, 2015

by

Emma Van de Wetering

The market for houses with basement apartments is about to get a little hotter. CMHC has announced it will allow 100% of the rental income from legal secondary suites to be used when qualifying for a mortgage. Currently it allows 50%.

The nation’s largest default insurer says the move is meant to “facilitate affordable housing choices for Canadians.”

“Secondary rental suites are recognized as a source of affordable housing offered at a cost that is often lower than those for apartments in purpose built rental buildings,” it adds. Secondary/basement suites also give lower-income Canadians the chance to live in single-family residential neighbourhoods.

The new rule takes effect September 28, 2015.

“This is definitely good news for anyone who is looking to buy a home and subsidize the cost” with a renter, says Vancouver-based broker Peter Kinch, of DLC’s Peter Kinch Mortgage Team. “…The ability to utilize 100% of the rental income to qualify for the mortgage…can certainly make the difference for many homeowners and may move a larger number of homebuyers from condo purchases to a single-family home with a mortgage helper.”

Broker Marg Green, of Concierge Mortgage Group, agrees that “there will be a big demand for it,” but rightly notes that more clarity is needed on what CMHC considers a legal suite. “What is legal? Is it fire retrofitted? Is it registered with the city? If the suite isn’t legal, lenders generally won’t use the rental income (for qualification purposes).”

Here’s what we’ve gathered thus far, with respect to what’s required to use 100% of suite income with CMHC:

- The property must be owner-occupied.

- The property being insured can have only two units (i.e., a duplex or a single home with a legal secondary suite).

- Rental income cannot be used if the suite is “illegal/non-conforming” but “legal non-conforming” is okay. (Non-conforming means that the suite was grandfathered in before zoning/regulations restricted such units. You can check with the city to confirm if a suite is legal.)

- The suite must be self-contained with its own entrance.

- Property taxes and heat must be factored into the borrower’s debt ratios (which is currently not the case when using rent from legal secondary suites).

- For existing units, there must be two-year history of rental income from the suite. The maximum rental income allowed for qualification is a two-year average of the unit’s rent.

- For new units, a market rent appraisal can be accepted if an appropriate vacancy rate has been applied to the estimated rental income.

- Mortgage applicants must “demonstrate a strong history of managing credit” with a minimum credit score of 680.

On 3-4 unit owner-occupied properties and 1-4 unit non-owner occupied rentals, CMHC will be allowing a net rents calculation (i.e., gross rents less operating expenses).

Note that individual lender guidelines may very well be tighter than what you see above.

Genworth and Canada Guaranty have had a 100% add-back policy for a while (for basement suites), but mainly in Victoria and Vancouver. CMHC’s new policy extends nationwide. Both private insurers say they’re reviewing CMHC’s changes and haven’t decided if they’ll match this guideline. We’ll bet that one or both of them will.

“In the big picture, I do not see that this will have a significant impact on the overall housing market,” says Kinch. “But in certain suburban areas, this shift in CMHC policy will help speed up a trend that is already taking place, and that is the widening price-gap between single-family and multi-family (condo, townhome) homes.”

Another broker, who didn’t want to be named, said the move could encourage more people to lie about owner-occupying a property (i.e., say they’re living in one unit but renting out both units). That minor unavoidable side effect aside, CMHC deserves applause for trying to boost the stock of affordable rentals and allowing young homebuyers an alternative to condo living.

http://www.canadianmortgagetrends.com/canadian_mortgage_trends/2015/07/cmhc-to-allow-100-of-suite-income.html

Posted on

July 30, 2015

by

Emma Van de Wetering

Limiting foreign investment would hurt sales and cost jobs: province

When Premier Christy Clark threw cold water on Vancouver Mayor Gregor Robertson’s call for measures targeting foreign homebuyers to cool the housing market — steps that have been taken in Australia, the U.K. and Singapore — she said such interference would have little effect on housing prices.

More importantly, it had the potential to harm the economy, according to the premier.

If the province drastically reduced foreign investment, it would have little impact on general housing prices, but would cause the loss of about $1 billion in residential real estate sales and 3,800 jobs in construction and real estate sectors.

It would also knock $350 million in nominal gross domestic product out of the economy, noted a B.C. Ministry of Finance analysis meant to back up Clark’s response.

If government action caused a 10 per cent fall in house prices, roughly $60 billion in home equity would be lost in the province, which would work out to about $85,000 for a homeowner in Metro Vancouver.

The analysis was based on using government policy to drive down a hypothetical foreign investment rate of five per cent to just one per cent of the total $27 billion in Greater Vancouver home sales in 2014.

Although there is no solid, clean data on foreign money, five per cent is considered the upper level of foreign investment by provincial estimates based on information provided by the real estate industry.

The province used an economic model from B.C. Statistics to estimate the impact on jobs and gross domestic product (GDP), a widely used measure of economic activity.

It is clear that the provincial government wants to be careful about tampering with the real estate and property development sector as it believes it is an important driver of the economy.

So, how important is this sector that is under so much scrutiny?

According to Statistics Canada data from 2011 provided to The Vancouver Sun, the latest numbers that are available for a detailed sector-by-sector break down, real estate agents, brokers and related activities generated $1.93 billion in GDP in B.C.

That is a contribution of just under one per cent of the province’s total GDP in 2011, and equivalent to the contribution by computer design and related services, truck transportation and legal services.

The real estate sector’s contribution was the same in 2009 and 2010. A report by the Real Estate Association of B.C. using 2007 data also found that the real estate sector contributed about one per cent to the province’s GDP.

The report on economic impacts also found that for every 100 house sales, $2 million in GDP was generated and the equivalent of 28 jobs were created. That year, the 102,000 home sales in the province on the multiple listings service (MLS) accounted for the equivalent of 28,000 jobs created.

The report noted that whenever homes are bought and sold, lawyers, appraisers, realtors, surveyors and other professionals collect fees. Governments also collect significant taxes, and many homebuyers renovate their homes to suit their lifestyles.

As well as the commissions and fees that have to be paid out, realtors must provide supplies and services to their offices where technology is increasingly important, said Dan Morrison, a realtor for 25 years and president-elect of the Real Estate Board of Greater Vancouver.

A hot market can also create increasing economic spinoffs, said Morrison, one of the 12,000 real estate agents in the Greater Vancouver area.

“Usually, you would have one home inspector, but in this market it’s not unusual to get five or six inspectors the day before the offers are presented so the people can present that offer without it being subject to inspection,” observed Morrison.

Cameron Muir, an economist with the B.C. Real Estate Association, says while the real estate sector directly does have an effect on the province’s economic output, it is the construction sector that delivers a bigger economic bang.

“When you build a house, there’s a tremendous amount of economic activity,” said Muir.

Statistics Canada data shows that residential construction contributed 2.7 per cent to GDP in 2011, nearly three times as much as the real estate sector.

A report by the Urban Development Institute, a group representing a broad spectrum of the development industry including developers, lawyers, bankers and real estate professionals, found in a study using 2012 data that the property development industry generated $8.17 billion in GDP, a little under four per cent of the provincial total.

The analysis encompassed construction of all buildings, property development, heavy and civil engineering and specialty sub-contracting. Residential construction made up about 75 per cent of the $20 billion in construction in 2012.

“The residential sector, broadly defined, does play a significant role. So,

changes in the demand for real estate will filter through the real estate economy and hence the broader economy,” says Central 1 Credit Union economist Helmut Pastrick.

“There are obviously indirect and induced spinoff benefits. When you start adding that up, it starts becoming a larger number,” said Pastrick.

Simon Fraser University economist Andrey Pavlov thinks the effect of the real estate sector — taken in the broadest sense to include the banking system which relies on mortgages for a significant portion of their business — is even bigger than the data on direct impacts shows.

“It’s hard to find hard data on that, but my feeling is that it’s a lot more. It’s more like 25 per cent,” said Pavlov, who specializes in real estate finance. “We don’t have any manufacturing really to speak of — with the exception of mining and forestry. Most of our industries are really real estate, finance, insurance and a bit of services.”

Across the border, analysis by the National Association of Realtors produces a higher relative contribution to GDP for the real estate sector with the inclusion of title insurance, rental and leasing, house appraisals, moving truck services and other related activities.

In Washington State, the real estate sector’s contribution was 16.6 per cent of GDP, while in Oregon it was 15 per cent.

“I think the premier is rightfully concerned that if we do something to the real estate market, that will have a negative impact on the economy,” said Pavlov.

Still, he believes the market is overheated and some action should be taken.

But Pavlov explains the rise in prices largely as a result of low interest rates and aggressive lending by banks, who take on very little risk because mortgages are backed by federal insurance through the Canada Mortgage and Housing Corp.

If the concern is that real estate is getting too expensive, the first step is to remove the subsidy and normalize interest rates, said Pavlov.

“In other words, don’t pour additional resources into real estate. Don’t get people to over-extend themselves. That to me is the proper response,” he said.

The federal government has taken some steps in an attempt to stem Canada’s hot real estate market, including reducing amortization periods and not providing CMHC insurance for homes worth more than $1 million.

However, the Bank of Canada lowered its benchmark overnight landing rate by 25 basis points to 0.5 per cent on July 15, a move that was promptly followed by the major banks.

University of B.C. economist Tsur Somerville believes slowing down price increases wouldn’t necessarily be a bad thing, but says you have to be careful not to use a big policy hammer that drives the market into a serious decline, given that the wider real estate construction market is important to B.C.

“You want to try to get a soft landing when you cool things down,” said Somerville.

He said any policies should directly target issues that are causing harm, which is difficult to pinpoint given the dearth of data on variables such as foreign investment.

He also noted you are contending with population increases in the Vancouver region largely driven by immigration.

Still, Somerville suggested that it may make sense to consider policies that deal with non-resident buyers and vacant properties, but also a broad-based supply response.

That could include increased density in more areas, and even allowing subdivision of lots to build additional single-family homes, he said.

Muir, the economist with the B.C. Real Estate Association, is frustrated with the current debate, arguing there is no crisis, and noting that apartments and condos have only increased in price five to six per cent since the financial crisis in 2008, while it is the stock of diminishing detached housing that is increasing in price.

Says Muir: “Why are we trying to devise a solution to a problem we don’t know exists?”

ghoekstra@vancouversun.comwith files from Postmedia News

Read more: http://www.vancouversun.com/business/Tinkering+with+housing+market+could+dangerous+economy/11241388/story.html#ixzz3hO3CYbeP

Posted on

July 30, 2015

by

Emma Van de Wetering

Be prepared to feel the heat if you’re in the housing market. The British Columbia Real Estate Association released their second quarter results, and demand for homes in the province are the highest they’ve been since 2007.

According to the report, Vancouver and the Fraser Valley are leading BC’s housing growth with a 16 and 17 percent increase in sales, respectively.

Demand for single family homes in Vancouver will go down, while demand for apartments will go up, so expect to see more construction of multi-family buildings over the next year.

The city will also see the average home price shoot to $870,000, which is an increase of seven percent. The board says to expect that number to grow to nearly $900,000 in 2016.

“Market conditions in Vancouver have improved as a result of consumer demand rising faster than the number of homes for sale. While the market is exhibiting sellers’ market conditions overall, there is variability according to product type and its location in the region,” reads the report.

The BCREA notes that foreign investment persists, but it remains a “relatively small, niche market” in the luxury sector.

The average price for an apartment in Vancouver is $465,000, up 1.4 percent.

http://www.vancitybuzz.com/2015/06/vancouver-real-estate-facing-highest-demand-eight-years/

Posted on

July 17, 2015

by

Emma Van de Wetering

While some are betting the Vancouver housing bubble is about to burst, Royal LePage is predicting the value of a home will rise 10 per cent in 2015.

The detached two-storey and bungalow homes continue to be Vancouver’s most sought-after properties, with prices rising about 13 per cent between the second quarters of 2014 and 2015. For condo owners, values rose as well, but at a slower pace at 6 per cent.

For all property types, Royal LePage forecasts that home prices will rise 9.4 per cent on average by the end of this year. The cost of owning a home in Toronto is also quickly rising at a rate similar or just above Vancouver. Prices there should increase 9.6 per cent come December.

“The robust national average home price increases that we have seen in the second quarter are heavily influenced by activity levels in Toronto and Vancouver,” said Phil Soper, president and chief executive officer, Royal LePage. “The housing industry in both cities boasts a foundation of prosperous labour markets driving demand for housing that is in limited supply – above average price increases aren’t going away any time soon. Looking to Canada as a whole, 2015 is shaping up to be a record year for housing, despite the cloud of economic uncertainty caused by low oil prices and twitchy global economies.”

Vancouver and Toronto remain Canada’s hottest markets, followed by Hamilton, Ontario, which has seen roughly a 12 per cent growth rate for detached two-storey and bungalow homes.

Condo owners in Halifax, Toronto, Edmonton, Vancouver and Victoria have seen the biggest increase in value averaging at about a 5 per cent growth rate, whereas condo markets in Winnipeg and Regina fall and Calgary and Montreal see mediocre increases.

A standard two-storey home in Vancouver now sits at $1,368,125 and a bungalow at $1,247,125. A condo is averaging $506,624.

http://www.vancitybuzz.com/2015/07/vancouver-housing-prices-rise-10-percent-2015/

Posted on

July 17, 2015

by

Emma Van de Wetering

The Bank of Canada today announced that it is lowering its target for the overnight rate by one-quarter of one percentage point to 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

Total CPI inflation in Canada has been around 1 per cent in recent months, reflecting year-over-year price declines for consumer energy products. Core inflation has been close to 2 per cent, with disinflationary pressures from economic slack being offset by transitory effects of the past depreciation of the Canadian dollar and some sector-specific factors. Setting aside these transitory effects, the Bank judges that the underlying trend in inflation is about 1.5 to 1.7 per cent.

Global growth faltered in early 2015, principally in the United States and China. Recent indicators suggest a rebound in the U.S. economy in the second half of this year, and growth is expected to be solid through the projection. In contrast, China is slowing amid an ongoing process of rebalancing to a more sustainable growth path. This has pulled down prices of certain commodities that are important to Canada’s exports. Financial conditions in major economies remain very accommodative and continue to provide much-needed support to economic activity. Global growth is expected to strengthen over the second half of 2015, averaging about 3 per cent for the year, and accelerate to around 3 1/2 per cent in 2016 and 2017.

The Bank’s estimate of growth in Canada in 2015 has been marked down considerably from its April projection. The downward revision reflects further downgrades of business investment plans in the energy sector, as well as weaker-than-expected exports of non-energy commodities and non-commodities. Real GDP is now projected to have contracted modestly in the first half of the year, resulting in higher excess capacity and additional downward pressure on inflation.

The Bank expects growth to resume in the third quarter and begin to exceed potential again in the fourth quarter, led by the non-resource sectors of Canada’s economy. Outside the energy-producing regions, consumer confidence remains high and labour markets continue to improve. This will support consumption, which will also receive a fiscal boost. Recent evidence suggests a pickup in activity and rising capacity pressures among manufacturers, particularly those exporters that are most sensitive to movements in the Canadian dollar. Financial conditions for households and businesses remain very stimulative.

The Bank now projects Canada’s real GDP will grow by just over 1 per cent in 2015 and about 2 1/2 per cent in 2016 and 2017. With this revised growth profile, the output gap is significantly larger than was expected in April, and closes somewhat later. The Bank anticipates that the economy will return to full capacity and inflation to 2 per cent on a sustained basis in the first half of 2017.

The lower outlook for Canadian growth has increased the downside risks to inflation. While vulnerabilities associated with household imbalances remain elevated and could edge higher, Canada’s economy is undergoing a significant and complex adjustment. Additional monetary stimulus is required at this time to help return the economy to full capacity and inflation sustainably to target.

Information note:

The next scheduled date for announcing the overnight rate target is 9 September 2015. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the Monetary Policy Report on 21 October 2015.

Posted on

July 3, 2015

by

Emma Van de Wetering

Last month was the highest selling June, and the second highest overall monthly total, on record for the Real Estate Board of Greater Vancouver (REBGV).

The REBGV reports that residential property sales in Metro Vancouver* reached 4,375 on the Multiple Listing Service® (MLS®) in June 2015. This represents a 28.4 per cent increase compared to the 3,406 sales recorded in June 2014, and an increase of 7.9 per cent compared to the 4,056 sales in May 2015.

Last month’s sales were 29.1 per cent above the 10-year sales average for the month. It’s the fourth straight month with over 4,000 sales, which is a first in the REBGV’s history. The previous highest number of residential home sales was 4,434, recorded in May 2005.

“Demand in our detached home market continues to drive activity across Metro Vancouver,” Darcy McLeod, REBGV president said. “There were more detached home sales in the region last month than we’ve seen during the month of June in more than 10 years.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $694,000. This represents a 10.3 per cent increase compared to June 2014.

“Housing market activity comes in cycles; we're in an up cycle right now that looks similar to the mid-2000s,” McLeod said. “It would be easy to point to one factor that's causing this cycle, but the truth is that it's a number of different factors.

"Conditions today are being driven by low interest rates, a declining supply of detached homes, a growing population, a provincial economy that's outperforming the rest of Canada, pent-up demand from previous years and, perhaps most importantly, the fact that we live in a highly desirable region," McLeod said.

New listings for detached, attached and apartment properties in Metro Vancouver totalled 5,803 in June. This represents an 8.7 per cent increase compared to the 5,339 new listings reported in June 2014.

"We’re seeing a steady stream of new listings entering the market, but the overall number of homes for sale is not keeping up with buyer demand," McLeod said.

The total number of properties currently listed for sale on the region’s MLS® is 12,181, a 23.9 per cent decline compared to June 2014 and a 1.3 per cent decline compared to May 2015. This is the lowest active listing total for June since 2006.

The sales-to-active-listings ratio in June was 35.9 per cent. This is the highest that this ratio has been in Metro Vancouver since June 2006. A seller’s market typically occurs when this ratio exceeds 20 per cent for a sustained period of time.

“The competition in today’s market means that buyers have less time to make decisions,” McLeod said. “Given this, it’s important to work with your REALTOR® to gain insight into the local market, to get quick access to new MLS® listings, to develop a buying strategy that meets your needs and risk appetite, and to receive other services and protections that come from having professional representation.”

Sales of detached properties in June 2015 reached 1,920, an increase of 31.3 per cent from the 1,462 detached sales recorded in June 2014, and a 74.2 per cent increase from the 1,102 units sold in June 2013. The benchmark price for a detached property in Metro Vancouver increased 14.8 per cent from June 2014 to $1,123,900.

Sales of apartment properties reached 1,774 in June 2015, an increase of 35.6 per cent compared to the 1,308 sales in June 2014, and an increase of 66.1 per cent compared to the 1,068 sales in June 2013. The benchmark price of an apartment property increased 5.3 per cent from June 2014 to $400,200.

Attached property sales in June 2015 totalled 681, an increase of 7.1 per cent compared to the 636 sales in June 2014, and a 44.3 per cent increase from the 472 attached properties sold in June 2013. The benchmark price of an attached unit increased 7.1 per cent between June 2014 and 2015 to $506,900.

*Editor’s Note: Areas covered by Real Estate Board of Greater Vancouver include: Whistler, Sunshine Coast, Squamish, West Vancouver, North Vancouver, Vancouver, Burnaby, New Westminster, Richmond, Port Moody, Port Coquitlam, Coquitlam, New Westminster, Pitt Meadows, Maple Ridge, and South Delta.

Posted on

June 16, 2015

by

Emma Van de Wetering

Will more taxes solve housing affordability challenges? History says no and so do we.

Re: Vancouver mayor seeks to curb housing speculation, June 4

The rising cost of homes in our region is well-documented. Metro Vancouver home prices have increased nearly 80 per cent since 2005. Detached home prices have increased over 100 per cent.

We worry about how our children can afford a home and how the most vulnerable among us can find basic shelter. These concerns have led to public debate about possible solutions.

One suggestion is for government to introduce new taxes. Some believe government should tax non-Canadian investors who buy properties. Mayor Robertson believes there should be a "luxury housing" tax on the sale of the most expensive homes in Vancouver.

We believe more taxes won’t help. Taxes bring unintended consequences. There’s little to no evidence that a luxury or foreign buyer tax would make homes more affordable.

History tells us that taxes like this fail to have the desired impact and succeed in permanently adding to government coffers.

In 1987, the provincial government implemented what was advertised as a “wealth tax”. It was supposed to apply to the sale of the most expensive five per cent of homes sold in BC. It's been 28 years since that tax was introduced and the thresholds have never been adjusted for inflation.

Today, that tax is known as the Property Transfer Tax (PTT). It’s applied to 95 per cent of all residential property sales in the province. This tax makes housing less affordable.

The home is where many people’s financial net worth resides. It's one of the last major assets that residents can sell and not pay a tax on the revenue. A little mentioned fact is that we already have tax disincentives for foreign owners. If a foreign home owner wants to sell a property in Canada, they are unable to receive a capital gains exemption.

The picture of affordability and home ownership is changing in Metro Vancouver. Our region's affordability challenges are complicated and, unfortunately, there isn't a single action that can solve them. Economists will tell you that offshore investment is a factor in today’s market. To what extent, no one has the data to know.

What we do know is that local conditions have a much more significant impact. We live in one of the most beautiful, progressive and prosperous areas of the world. There are more people who want to live here than there are homes available. This causes prices to rise.

The natural solution would be to create more supply, but we're constrained by mountains to the north, an ocean to the west, and a border to the south.

Despite the headlines, the majority of home sales in Metro Vancouver are not $1-million and beyond. Based on our Multiple Listing Service® (MLS®) statistics, nearly 70 per cent of all sales in the region last year were below $800,000.

The price of condominiums today ranges between $200,000 and $600,000 depending on size and location. Townhomes range between $300,000 and $800,000 in the region.

Detached homes in the City of Vancouver are at the high-end of our market. Recent activity has pushed homes on the Vancouver Westside above $2.5 million.

It’s a different story in neighbouring communities. The benchmark price of a detached home in Maple Ridge today is $499,100; in Ladner the benchmark price is $713,200; in Coquitlam the benchmark price is $845,400.

Affordability challenges exist. But there are also more options and aspects to the story than is typically discussed in the media. Certainly more than the mayor is putting forward.

Sincerely,

J. Darcy McLeod

President of the Real Estate Board of Greater Vancouver

Posted on

June 11, 2015

by

Emma Van de Wetering

2222 Paradise Avenue Coquitlam.

Virtual Tour: http://tours.total360.ca/public/vtour/display/358969

Posted on

June 11, 2015

by

Emma Van de Wetering

Many new home shoppers are facing a financial quandary.

“Should we buy now or wait. And if we do buy now, what if…?” they may rhetorically ask themselves. What if prices go down? Is this the bottom of the market? If the downturn becomes prolonged will there be better deals ahead? Are interest rates going to climb or fall?

“There are so many scenarios making the rounds out there that those shopping the new home market just aren’t sure what to do,” says Chris Pollen, sales and marketing manager at Avi Urban, the multi-family division of Homes by Avi.

Instead of pondering whether prices will go down, Pollen says, “what if mortgage rates go up,” how will that affect that buying decision?

“Posted interest rates are the lowest they’ve been in a long time, and new home prices are unlikely to go down, why would they when supplier and trades’ costs to builders are still high,” he adds. The weaker Canadian dollar means many building supplies are more costly these days.

The mortgaging options available to consumers is varied, says Laura Parsons, mortgage expert with BMO in Calgary.

“If you are just starting out on the road the home ownership, it’s important to talk to a mortgage expert so you know the options and programs available to help you along that road,” she says.

Based on figures provided to Pollen by the Bank of Montreal, a half-point rise in the current mortgage rate environment — which sees the five-year posted rate at 4.74 per cent — could bring with it an increase of between $25,000 and $30,000 in interest costs over the life of a 25-year mortgage. Also included in this calculation is an expected increase in Canada Mortgage and Housing Corp. premiums for mortgage loan insurance.

“We want to get this message out to people visiting our show homes, to educate them a bit more about what might happen under this scenario,” Pollen says.

Parsons says the mortgage rate figures presented are not a prediction but are a guide for home buyers, particularly those getting into ownership for the first time.

“Rates are the lowest they’ve been in 30 years, and right now there is no indication they’ll be going up,” she says. “But we just wanted to further educate buyers with a what-if scenario.”

The new home marketplace is still active with new construction, and Calgary is continuing to see the impact of strong migration numbers over the past three years. Many of those new Calgarians are currently renting, but actively shopping the ownership market.

Tim Logel, president and partner of Cardel Lifestyles, says it’s an almost impossible challenge to try to time the bottom of the market because there can be so many variables in play.

But today’s home buyers are a shrewd and educated group, they’ve done their financial homework, are pre-qualified, and are out shopping. Show home traffic, he says, is still good. And when you have good traffic numbers that’s a good indicator that those visitors are serious buyers.

“They’ve crunched the mortgage numbers, and are continually watching the rate, not wanting to lose the opportunity that exists today when mortgage rates are so low. Seize the day, so to speak,” says Logel.

Bill Bobyk, vice-president of Sterling Homes, says the question of when to buy has always been part of the decision-making process — and likely always will be.

But, he says, there are two compelling reasons to buy now.

The first is the fact that with five-year money available at around 2.5 per cent and 10-year rates sitting under four per cent, giving consumers an opportunity to borrow cheap money.

“Not sure whether those rates will go up or not anytime soon, but true probability of them going down further to any degree are low compared with them going up considerably over the term of the mortgage,” Bobyk says.

The second is that in Calgary where the market has softened, some builders are offering “incentives” to buy.

But this could be short-lived as the supply of available, completed new homes is definitely shrinking along with the ever-decreasing supply of serviced land.

“On balance, this is a great time to buy,” Bobyk adds.

Posted on

June 11, 2015

by

Emma Van de Wetering

Life is a journey. Couples buy the big house when they start their families. But when their kids fly the coop, they're stuck with a too-big house that no longer meets their needs or fits their lifestyle. The thought of starting over can be daunting.Over the years after helping scores of empty-nesters downsize, we've found that folks sometimes lose their way during this phase. Here are our top tips to help keep everyone on track:No one loves your stuff as much as you doThe first three things we tell empty-nesters to do to get their home ready for market is to de-clutter, de-clutter, de-clutter. It's amazing how many things one can accumulate over a lifetime. As we age, we also tend to hold onto things as they connect us with our past. We know firsthand. We lost our dad almost 20 years ago, and to this day, our mom still refuses to throw out any of his belongings. Unfortunately, things that we think are important to our children may not be, and things that we think are disposable may have tremendous intrinsic value to our loved ones.Here's how you can fight the urge not to purge:Hire a professionalIf you have found excuses for the last 25 years not to purge, it's unlikely that you can do this alone. Many of our clients work with professional organizers and/or estate sales companies to help them get through this process. A professional organizer can help you sort through decades of paperwork and belongings in an organized and systematic way. A professional estate sales company can help you sort through which items have value and which do not, and then sell them for you.De-clutter on the front endIf you get something new, throw something old out. One in, one out. If you have too much stuff, change the ratio. For example, if you buy a new shirt, get rid of two or three old ones.The good news is that de-cluttering is a cathartic process. While the journey of de-cluttering can be emotionally difficult, our clients routinely feel free and less burdened when they are done. In fact, the vast majority of our clients tell us that they wish they had done it years earlier.Move when you can, not when you have toDon't stay too long. It's easy to do. You've raised your family in a home, and have a lifetime of memories there. It's a growing trend for empty-nesters to modify their homes — by installing elevators and creating wide spaces to accommodate wheelchairs, for instance — to meet their needs as elderly people. Unfortunately, not every house can be adequately modified. And modifications can't erase all the unneeded space in the family home.We've seen it happen way too often — elderly homeowners start to lose the ability to maintain the house, whether for financial, physical or other age-related reasons. That's when bad things start to happen.We've had clients refuse to leave their multi-level homes, despite the advice from their doctors and often, their spouse and/or grown children. It usually takes a calamitous event — such as a tumble down a staircase, an illness or injury or financial ruin — to force the issue. By then, it's far more difficult, painful and almost always financially sub-optimal. If your loved ones are raising these issues with you, take them seriously and be honest with yourself. After a certain point, being stubborn is not just about engaging in an existential conversation with your grown children, it can be downright dangerous.Have the tough conversations while everyone is healthyNo one likes to talk about estate planning. It brings up very tough conversations and intergenerational differences and conflicts. We get it.However, it is infinitely easier to have these conversations when everyone is healthy and the conversations are more "hypothetical." Once someone is diagnosed with a terrible illness or has their health deteriorate, the last thing anyone wants to do is to talk about estate planning.Bottom line: Have meaningful conversations with your loved ones while everyone is healthy, and understand who really wants what. It's much more fun to gift things while you're alive and healthy then after you're gone. - See more at: http://www.househunting.ca/buying-homes/Downsizing+tips+empty+nesters/10868137/story.html#sthash.I9UBwgg3.dpuf

Posted on

June 11, 2015

by

Emma Van de Wetering

Dear Tony: We have a number of complaints about our depreciation report and our depreciation planner. The engineering company that the strata hired provided several technicians to develop our report and they were excellent to work with. That's where our satisfaction ended. The engineer who authored the final report has interpreted our bylaws and imposed a number of recommendations that we did not ask for that have now unfairly raised a number of unsubstantiated claims about our building, and incorrectly interpreted our bylaws. The company is refusing to correct the report and now we are not sure how to address this.

— Bonnie W. Surrey

Dear Bonnie: A depreciation report is a mandatory planning tool for all strata corporations of five units or more unless they pass an annual three vote resolution to exempt. There are a number of key terms used in the Strata Property Act that indicate the report is simply an information report which is based on estimates of building common asset conditions, life expectancies, and replacement costs.

The report also includes an evaluation of the current financial status of the strata, and a projection of at least three funding models to help the strata owners with their decision making when funding future contingency reserve funds.

It would be helpful if the reports were accurate within a nominal margin of 15-25 per cent, but I have recently reviewed reports that indicate the funding estimates are plus or minus 50 per cent, which has the potential to render them ineffective or even harmful to the asset value of your property. The report does not give the depreciation planner the free license to impose interpretations of bylaws, the strata plan of the strata corporation, any easements or covenants. Their role and that of the document is estimated information, which is essential in managing risk and planning for the future.

A good example of a report that over interprets or is inaccurate, is one developed for a strata with sections created through the bylaws. The report attempted to incorrectly interpret and segregate expenses and future funding models by sections, but like an insurance policy of the strata corporation, the report contains all common assets of the corporation in the schedules without segregation. If there are exclusive expenses in the report that are to be funded purely by a section, that is the responsibility of the strata corporation and the sections to show in their annual budgets and funding responsibilities.

Interpretation of sections bylaws or air space parcel agreements frequently require a legal opinion before the strata understands their impact.

Reports may also publish statements that may cause an unfair risk or evaluation of the strata finances. For example, "according to the funding models, the strata contingency fund is currently underfunded by 1.3 million dollars". There is no such evaluation of funding in our legislation. If the strata choose to provide minimal funding in their contingency fund, then it simply means the owners will face higher special levies in the future. The reports do not set minimum funding standards. The depreciation report is basically a contract with a consultant. If your consultant is not prepared to correct errors in a report, it is a nominal cost for the strata to consider an action in small claims (provincial) court or a complaint to their regulating body.

Tony Gioventu is executive director of the Condominium Home Owners Association. Email tony@choa.bc.ca

- See more at: http://www.househunting.ca/theprovince/Condo+Smarts+Problems+arise+from+incorrect+report/11071208/story.html#sthash.I6onXEyg.dpuf

Posted on

June 7, 2015

by

Emma Van de Wetering

The demand for housing in British Columbia is at its strongest since 2007, according to the B.C. Real Estate Association.

In its 2015 second quarter housing forecast, released Monday, the association says residential sales in B.C. are forecast to rise 2.4 per cent this year and 3.9 per cent in 2016.

Meanwhile, residential sales prices are also forecast to shoot up 4.5 per cent this year and another 2.4 per cent next year.

While the projections fall well short of a record-setting 2005 (when 106,300 sales were recorded), it represents the strongest housing demand in the province since 2007.

The forecast was released as housing affordability in Vancouver has dominated headlines and public debate.

Also on Monday, Insights West released a new poll showing 73 per cent of British Columbians support an “Absentee Homeowner Tax” for people who acquire residential properties but don’t live in them.

Last month, real estate marketer Bob Rennie and Vancouver Mayor Gregor Robertson both publicly supported the idea for a provincial speculation tax targeting investors who sell property shortly after acquiring it for a quick profit.

Approximately 500 people attended a #donthave1million affordable housing rally at the Vancouver Art Gallery on May 24.

http://metronews.ca/news/vancouver/1384385/b-c-housing-demand-highest-since-2007-real-estate-association/

Posted on

June 7, 2015

by

Emma Van de Wetering

Nelson Rockefeller’s grandchildren probably don’t live in single-family detached homes in Manhattan. Neither will your kids live in such housing in Vancouver.

That message was delivered recently by condo king Bob Rennie, of Rennie Marketing Systems. He conveyed the notion that the world has moved on, that cities change, and that younger generations are adjusting their expectations, in a speech to the Urban Development Institute,

The fact is that Vancouver has been outed as a great hedge city, according to a recent article in the Harvard International Review. It argued that rich people, particularly from China and Russia, countries pairing capitalist economies with unpredictable authoritarian political systems, regard Vancouver as one of just a handful of cities that are safe, secure places to invest.

The article, written by Jessica Dorfmann, reports that “whole neighbourhoods are under construction” in Vancouver, and asks: “How long can Vancouver sustain these levels of growth and investment?

“And what will a sudden crisis in Beijing mean for Vancouver?”

The article observes that all the new investment has caused “an affordability crisis for what should be the next generation of local property owners.”

And there is no relief in sight because, while “hedge cities can hope for the best, in a truly globalized real estate market, their fates are out of their hands.”

That brings us back to Rennie, who is advocating a tax to curb real estate speculation, which would do nothing to address Vancouver’s problems as a hedge city. Foreigners invest their money here, in housing, for the longer term.

It also would not address property demand expected to continue from the thousands who move here annually.

Rennie acknowledges there is only one effective way to address lack of affordability: more density, much more. Not just on arterial streets but on quiet avenues.

Rennie is preparing us for the inevitable decline and fall of the single-family home in Vancouver. Think woolly mammoth.

Detached homes, he says, are “on the verge of extinction.” It is already happening. Between 2006 and 2011, the city lost 900 single-family homes.

Just look at Cambie Street, or the legion of homeowners newly afflicted by the land assembly bug, banding together to sell whole blocks to developers who will seek rezoning to build townhouses and condos.

Rennie says Vancouver has about 47,000 single-family homes and a limited land base. New, detached properties are not being created.

On my Kitsilano street, over the past year, two single-family houses were bulldozed, replaced by large duplex developments accommodating four families where formerly there were two.

There are more cars on the street, more dogs and kids and backyard barbecues but not more affordability: the half duplexes sold for nearly $2 million each. One sold three hours after a for-sale sign was posted.

Perhaps if enough multi-family developments proliferate, affordability will ease. Certainly no one has found a better idea to facilitate it.

High density throughout Vancouver would make this city look more like Manhattan or Paris, where apartments are the norm, including for families, and detached homes are nowhere to be found.

It is worth noting that in those cities, affordability is also elusive. Try buying a 600-square-foot apartment in central Paris; see how far your money goes.

To achieve affordability, Parisian home buyers move to the suburbs. This is happening, too, in Vancouver. As Rennie told his audience, “Main is the new Granville St., Fraser is the new Oak.”

The good news: millennials in Vancouver, aged 19-35, do not have the same expectations as baby boomers. They don’t necessarily see themselves joining the white-picket fence crowd.

A poll cited by Rennie reveals 81 per cent of millennials in Surrey, Richmond, Vancouver and Burnaby believe Greater Vancouver is headed in the right direction. “They’re happy, and they’re a force, and we’d better start understanding them.”

byaffe@vancouversun.com

http://www.vancouversun.com/opinion/columnists/Barbara+Yaffe+Single+family+detached+homes+endangered/11100051/story.html

Posted on

June 7, 2015

by

Emma Van de Wetering

The realisation that something is grotesquely awry with Vancouver’s housing market has reached a tipping point.

Fuelled by the special sauce of Chinese wealth - and good old Fear of Missing Out - prices have decoupled from the local economy, with an average detached price of about C$1.4 million (HK$8.9 million). So far, so normal for Vancouver.

But the past couple of months have witnessed a kind of awakening.

Chinese-Canadian Eveline Xia - herself an immigrant - helped get the ball rolling with her very first tweet on March 18, in which the 29-year-old environmental scientist created the hashtag #donthave1million, and posted a plaintive cry about the drain of young Vancouverites being priced out of the city she loves. “To thrive, does @CityofVancouver not need people like you and me?” she asked.

It hit a nerve. Fellow millennials jumped on board #donthave1million, posting their own tales of real estate woe.

Eveline Xia's March 18 tweet that kicked off the hashtag #donthave1millionAround the same time, a petition sprang up on change.org, demanding that BC Premier Christy Clark and local mayors “restrict foreign investment in Greater Vancouver's residential real estate market”. The petition had about 24,000 supporters as of Wednesday.

The various online and media rumblings will take solid form at a rally for affordable housing in downtown Vancouver on Sunday at noon.

Yet there are still pAnother #donthave1million tweet by a priced-out Vancouverite and her daughter.lenty of misunderstandings about the forces at play, on both sides of the debate.

One position states there’s nothing particularly unusual about Vancouver’s housing situation. Yet this

He doesn't have a million either.neglects the fact that the city’s unaffordability is now globally exceptional, exceeded only by that of Hong Kong.

Foreign money might be a factor, concede some, but it must similarly influence other markets, right? Not really – since immigration data demonstrates that the influx of rich immigrants to Vancouver (80 per cent of them Chinese) is unmatched by any other city in the world, at least in terms of wealth-migration schemes that clearly define asset benchmarks.

Others seek to frame unaffordability as inevitable, since Vancouver is a city of limited land supply. But plenty of other cities are in the same boat: New York and Singapore spring to mind. Both are expensive cities, but Vancouver has left them in the dust in terms of unaffordability. If Vancouver (price/income ratio 10.6) could achieve the affordability of New York (6.1), or Singapore (5.0) I’m betting that Eveline Xia would be dancing down Main Street.

Surely Vancouver has always been unaffordable? A quick check of the stats will show that as recently at 10 years ago, Vancouver’s price/income ratio was in dancing territory, at 5.3.

As for the perennial low-rates argument, pretty much everywhere has low rates. It tells us nothing about what makes Vancouver’s market special.

An exceptional cause must be found for an exceptional situation, and for Vancouver, that can be found quite easily in wealth migration, which exploded in the past decade.

Vancouverites still struggle to grasp the scale of this influx to their modestly-sized city. From 2005-2012, about 45,000 millionaire migrants arrived in Vancouver under just two wealth-determined schemes, the now-defunct Immigrant Investor Programme and the still-running Quebec Immigrant Investor Programme. Let’s put that in perspective. The entire United States only accepted 9,450 wealth migration applications in the same period under its famous EB-5 scheme, likely representing fewer than 30,000 individuals.

So, Vancouver has recently received more wealth-determined migration than any other city in the world, by a long stretch. This, in a city with some of the lowest incomes in Canada.

The flipside to these various misunderstandings is the current focus on Australian-style restrictions on foreign ownership (Canada doesn’t even bother to track foreign ownership, let alone restrict it). Such restrictions might be an admirable goal, but I very much doubt they would have great downward impact on Vancouver prices.

That’s because I have not encountered a single real estate purchase in Vancouver that would have definitely been proscribed by restricting “foreign” ownership. Not one. The concept of the foreign investor dominating Vancouver’s market may indeed be a myth, since “foreign” buyers typically have residency rights or dual citizenship in Canada, or are able to make their purchase via a suitably endowed proxy (ie: a spouse or child with residency).

Foreign buyers probably aren’t to blame for Vancouver’s unaffordability. But foreign money probably is. And cracking down on the foreignness of funds will prove much harder than dealing with the foreignness of buyers, even if the will to do so exists.

Another factor often neglected is that a successful “fix” for unaffordability would crush a great many people, probably as many as it helps. In peril would be a real estate and development industry that employs thousands. Anyone who already owns a home would also be at risk. Thousands of elders banking on their homes as a retirement nest egg. Thousands of recent buyers facing the terrifying prospect of negative equity, with mortgages far exceeding the value of their homes.

It’s no surprise the politicians are treading carefully.

Yet it would be a mistake to weigh the issue in cold terms of winners and losers, cost and benefit - because it is a fundamental matter of fairness. Is it fair that so many people have been so vastly enriched, through no great credit of their own, at the expense of so many who have been impoverished, ruined, or simply forced out of their city, through no great fault of their own? The dividing line isn’t one of intelligence, or diligence, or any other worthiness – mainly, it’s a demarcation of age, between those who were old enough to have bought before the wildest market rises, and those who were not.

Wherever you stand on the matter, the time for denialism is over. At the very least, Vancouver deserves its long-overdue debate about the root causes of the unaffordability crisis, and what to do about it.

*

The Hongcouver blog is devoted to the hybrid culture of its namesake cities: Hong Kong and Vancouver. All story ideas and comments are welcome. Connect with me by email ian.young@scmp.com or on Twitter, @ianjamesyoung70 .

Posted on

May 25, 2015

by

Emma Van de Wetering

A new heat map by Estate Block utilizes data from the National Household Survey to determine where different immigrant ethnicities reside in Metro Vancouver and across the South Coast.

The map, built by Estate Block and shared across Reddit, highlights where 10 of the most populous groups of immigrants live, including those from the United Kingdom, India, China, Philippines, Hong Kong, South Korea, Iran, United States, Netherlands and Taiwan.

Immigrants in Metro Vancouver by majority in the neighbourhood shows Chinese make up the largest proportion of immigrants in most of Metro Vancouver, particularly the City of Vancouver, Burnaby and Richmond.

Vancouver’s Kitsilano, Point Grey, Fairview and False Creek areas are predominately made up of immigrants from the UK, as well as the West End, much of North Vancouver, West Vancouver, Delta and Langely.

Iranians tend to live in West Vancouver’s British Properties and Ambleside area, lower North Vancouver, Coal Harbour, the Central Business District and Downtown South.

Immigrants from the Philippines make up the majority in some of East Vancouver, East Richmond and North Surrey.

According to the 2011 Census, there are 159,200 people living in Metro Vancouver born in China, 111,265 born in India, 87,945 from Philippines, 72,230 from Hong Kong and 61,255 born in the United Kingdom.

http://www.vancitybuzz.com/2015/05/immigrant-map-live-metro-vancouver/

|